On the form, you have to make a reasonable estimate of your tax liability for 2023 and pay back any equilibrium due using your ask for. Requesting an extension within a timely manner is very critical if you end up owing tax towards the IRS.

The solution to which way is best isn’t the exact same for everybody. It's going to depend upon your individual desire and circumstance and it’s up to you to help make your very own decision.

The IRS also acknowledges that it acquired your return, a courtesy you don’t get even if you send your paper return by Accredited mail. that can help you guard on your own from the curiosity and penalties that accrue Should your paper return will get missing.

Print out a tax checklist that can help you Obtain every one of the tax documents you’ll need to finish your tax return.

Tina Orem is surely an editor at NerdWallet. previous to becoming an editor, she coated modest business enterprise and taxes at NerdWallet. She has long been a monetary author and editor for over fifteen several years, and she includes a diploma in finance, as well as a master's degree in journalism and also a learn of enterprise Administration.

you need to do need to pay tax on any income that results from depreciation claimed to the office immediately after May six, 1997. It’s taxed in a greatest rate of 25%. (Depreciation makes taxable profit since it cuts down your tax foundation in the house; the reduce your foundation, the higher your financial gain.)

Typically, if You merely get paid revenue from the perform being an personnel and It really is less than the normal Deduction to your submitting status, you needn't file a tax return. the edge for needing to file a tax return is $400 of self-work Internet income.

Tax credits for Vitality-conserving home improvements may also retain extra money in the wallet All year long and at tax time.

immediately transfers facts from prior returns. If you’ve used this tax application in previous several years, the program means that you can transfer outdated facts on your new return, saving you time.

hold documents more time in certain situations — if get more info any of these circumstances use, the IRS has a longer Restrict on auditing you:

You concur that you'll be supplying to us your consent for us to Make contact with you regardless of any never connect with or never Email privacy possibilities you may have previously expressed till you revoke this consent, or as many as 90 times. you could possibly revoke your consent at any time by notifying the Merrill agent.

Make sure you know the worth you paid out for just about any shares or cash you've got sold. when you don’t, get in touch with your broker before You begin to prepare your tax return.

If you didn’t fork out adequate to the IRS over the 12 months, you may have a large tax Invoice staring you inside the experience. in addition, you could owe significant desire and penalties, too.

modern mortgage rates30 yr mortgage rates5-calendar year ARM rates3-12 months ARM ratesFHA home loan ratesVA house loan ratesBest home finance loan lenders

Molly Ringwald Then & Now!

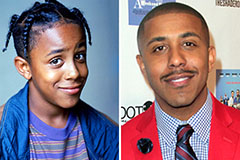

Molly Ringwald Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now! Daryl Hannah Then & Now!

Daryl Hannah Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!